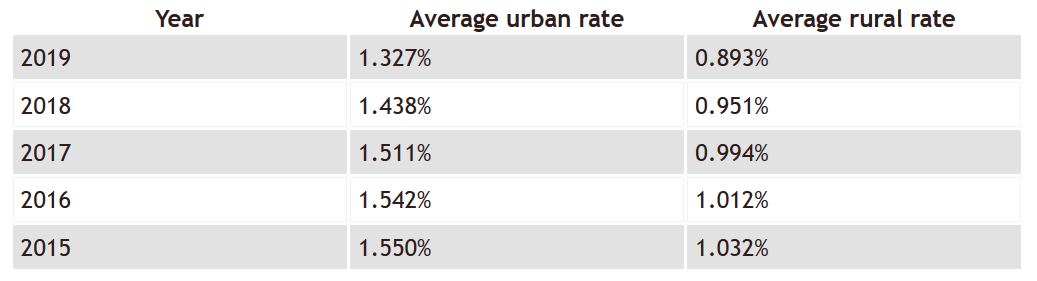

idaho sales tax rate in 2015

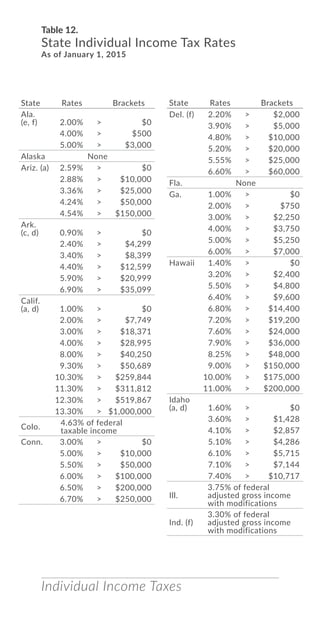

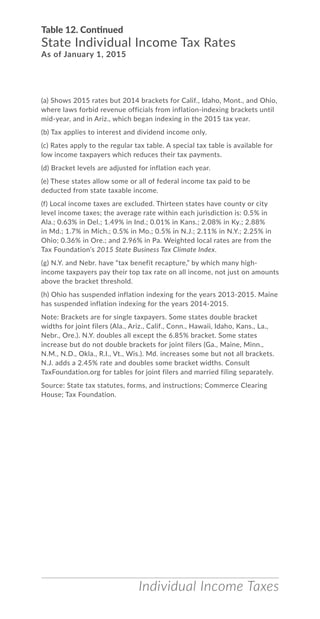

The table also notes the states policy with. The table below summarizes sales tax rates for Idaho and neighboring states in 2015.

How To Charge Your Customers The Correct Sales Tax Rates

Prescription Drugs are exempt from the Idaho sales tax Counties and cities can charge an.

. The County sales tax rate is. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Revenue distributions to counties highway districts and.

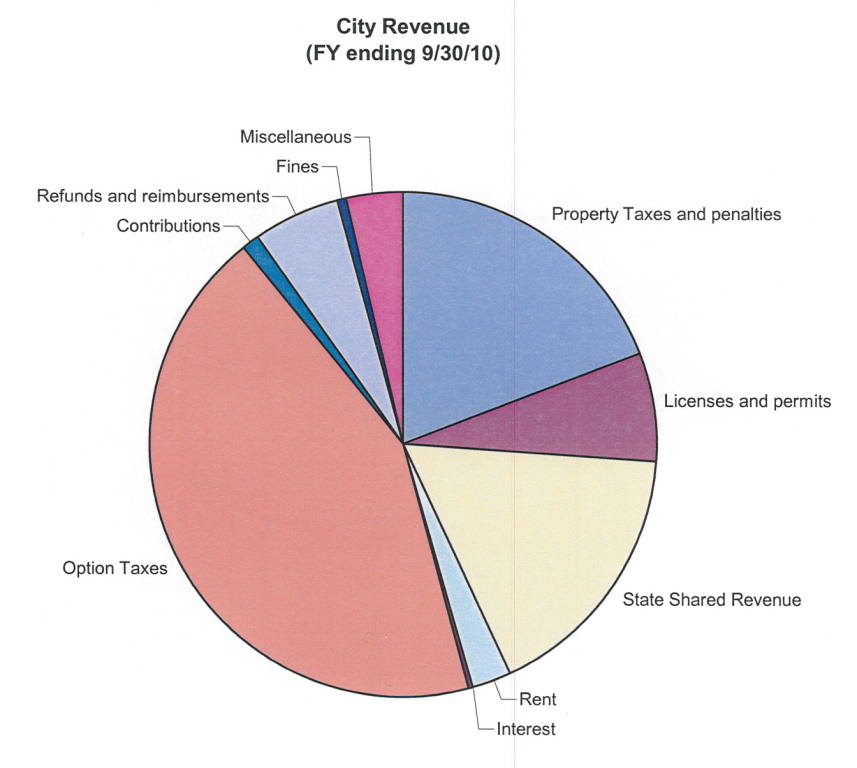

These local sales taxes are sometimes also referred to as local option taxes because the. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. The Idaho ID state sales tax rate is currently 6.

The use tax rate is the same as the state sales tax rate. The current state sales tax rate in Idaho ID is 6. One important thing to know about Idaho income taxes is that.

There is no applicable county tax city tax or special tax. The Idaho sales tax rate is currently. This is the total of state county and city sales tax rates.

A business might also owe use tax if it purchases. Five states have no sales tax. Idahos sales tax is 6 percent.

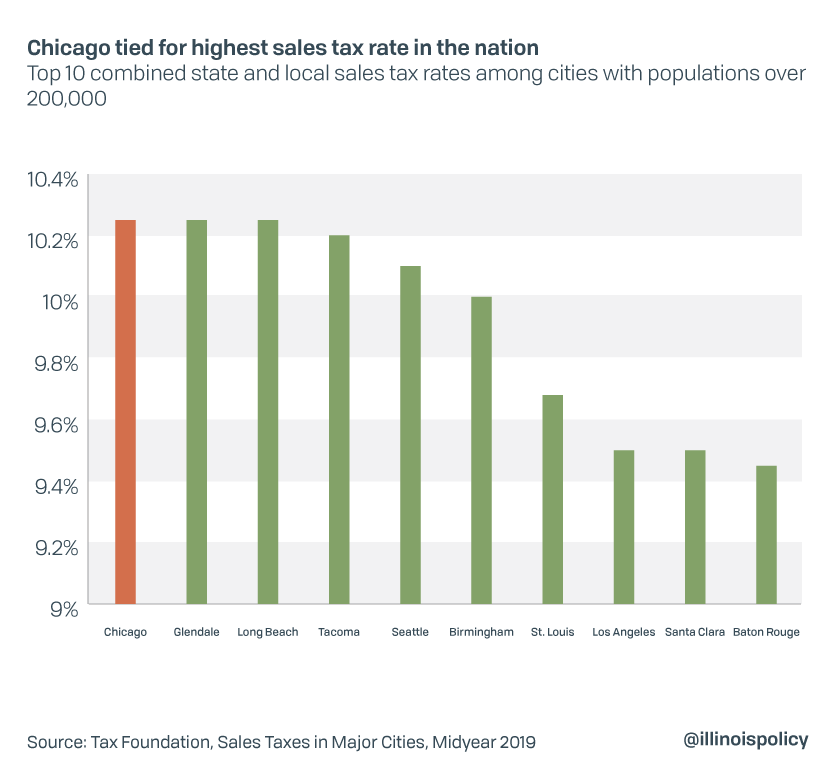

31 rows The state sales tax rate in Idaho is 6000. The total tax rate might be as high as 9 depending on local municipalities. Did South Dakota v.

Retailers need a sellers permit to conduct retail sales. Non-property taxes are permitted at the local level in. 3 lower than the maximum sales tax in ID The 6 sales tax rate in Arco consists of 6 Idaho state sales tax.

While many other states allow counties and other localities to collect a local option sales tax Idaho does. Idaho Sales Tax Rate The sales tax rate in Idaho is 6. Colorado has the lowest sales tax at 29 while California has the highest rate at 725.

The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. Idaho State Tax Commission. The sales tax rate in Idaho for tax year 2015 was 6 percent.

Some Idaho resort cities have a local sales tax in addition to the state sales tax. The Idaho Falls sales tax rate is. Tax rate may be adjusted annually according to a formula based on.

Sales Taxes In The United States Wikiwand

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Are You Paying Sales Tax On Online Shipping Fees Should You Csmonitor Com

Idaho Sales Tax Small Business Guide Truic

Download Sales Tax Rates Database By Zip Code Csv Format

Idaho Sales Tax Calculator Reverse Sales Dremployee

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Facts Figures 2015 How Does Your State Compare

The 2006 Tax Shift Still Divides Idaho Leaders

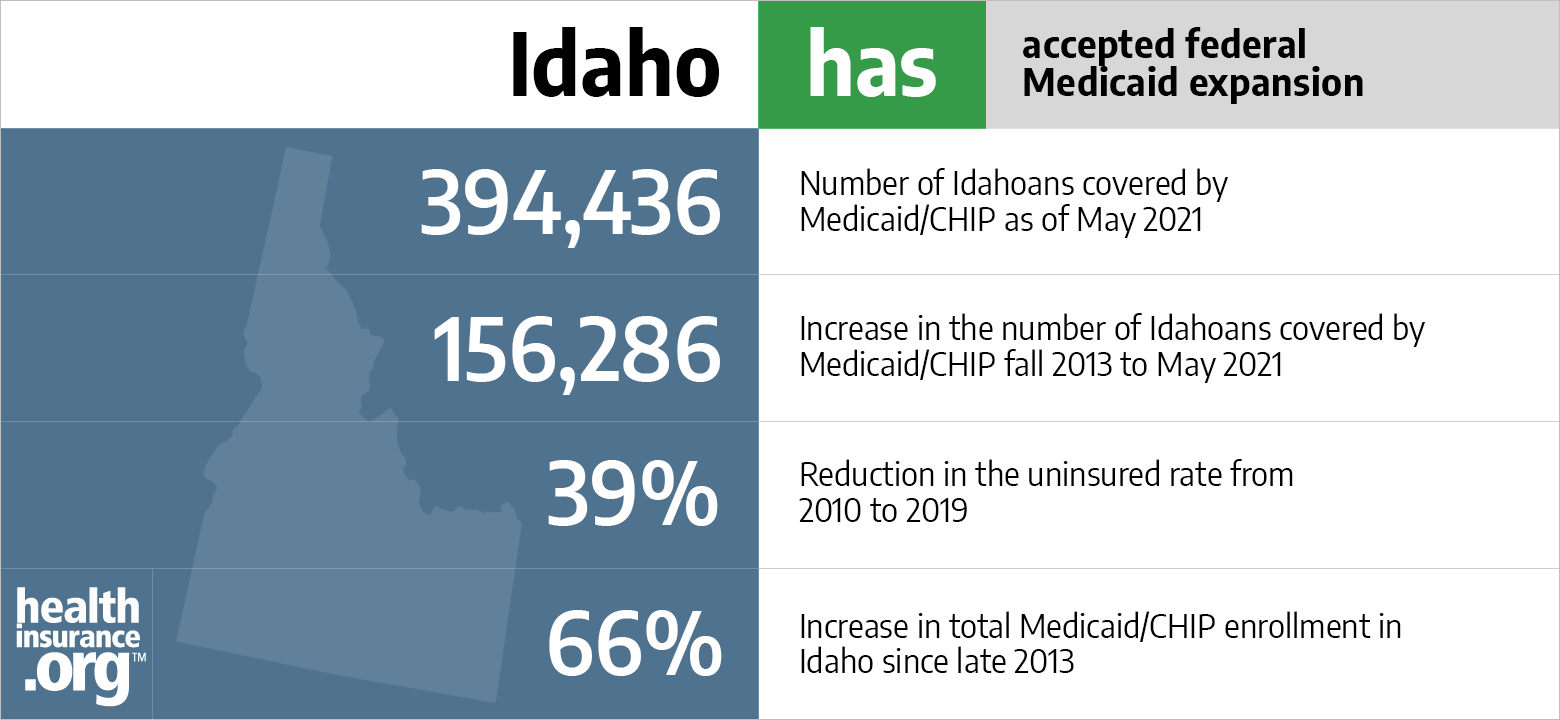

Aca Medicaid Expansion In Idaho Updated 2022 Guide Healthinsurance Org

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

Sales Tax By State Is Saas Taxable Taxjar

Exploding Population Boom In Idaho Is Affecting Domestic Water Supply Idaho Capital Sun

Facts Figures 2015 How Does Your State Compare

2022 Property Taxes By State Report Propertyshark

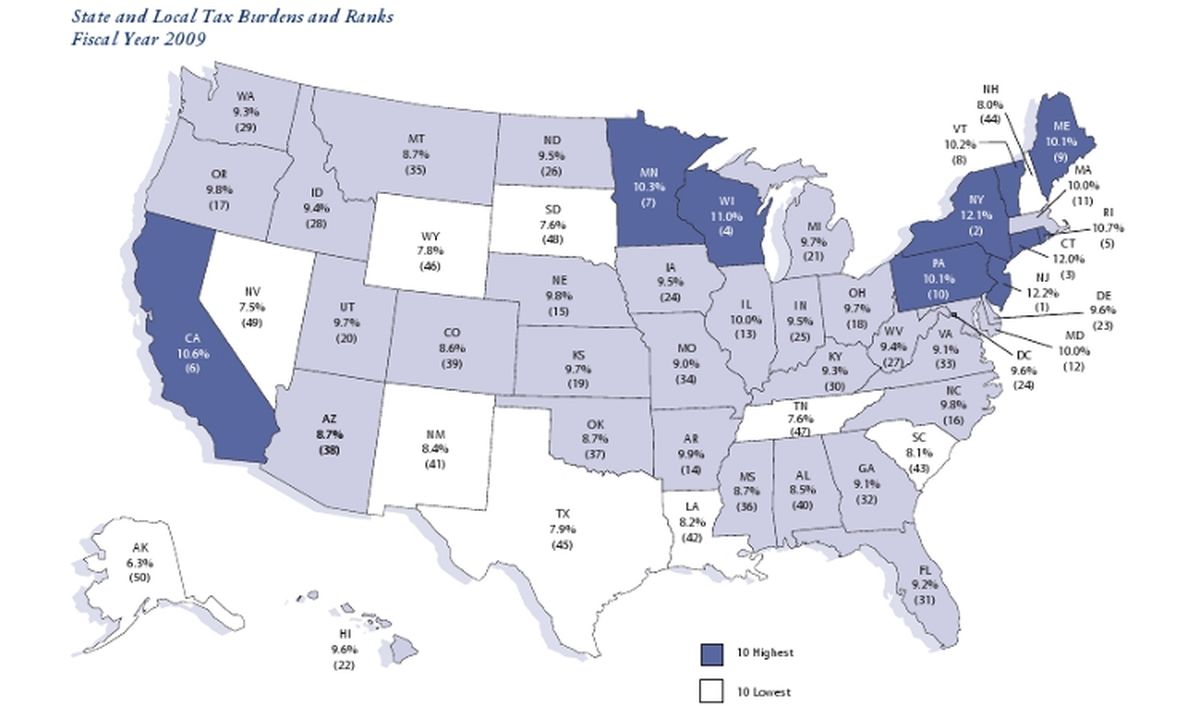

State Taxes On Your Mind Let S Compare Idaho Vs Washington In Total Tax Burden The Spokesman Review